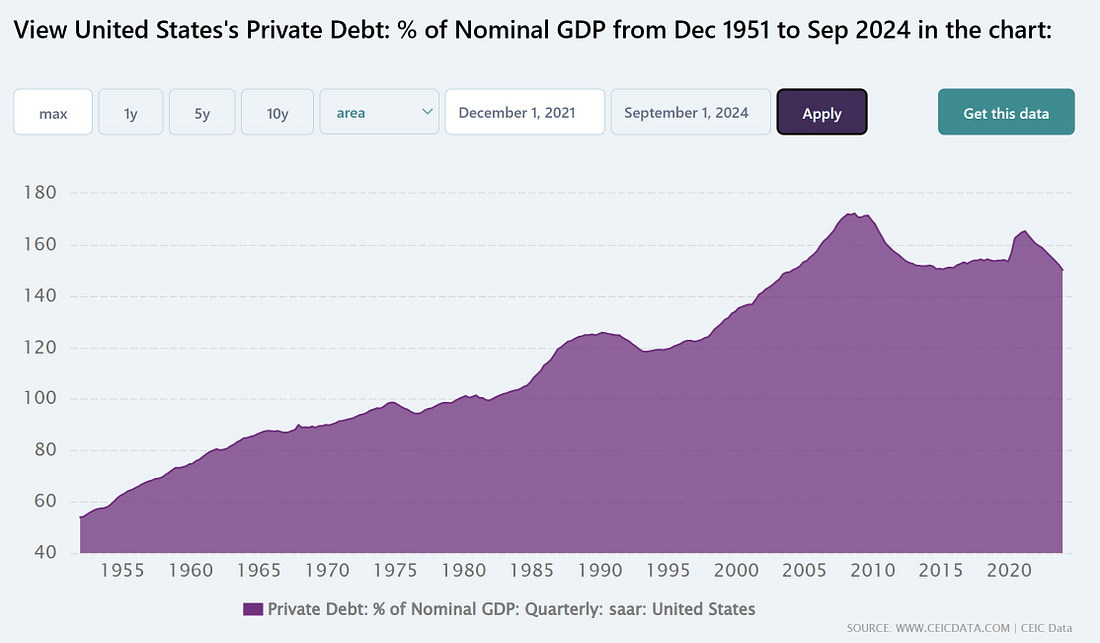

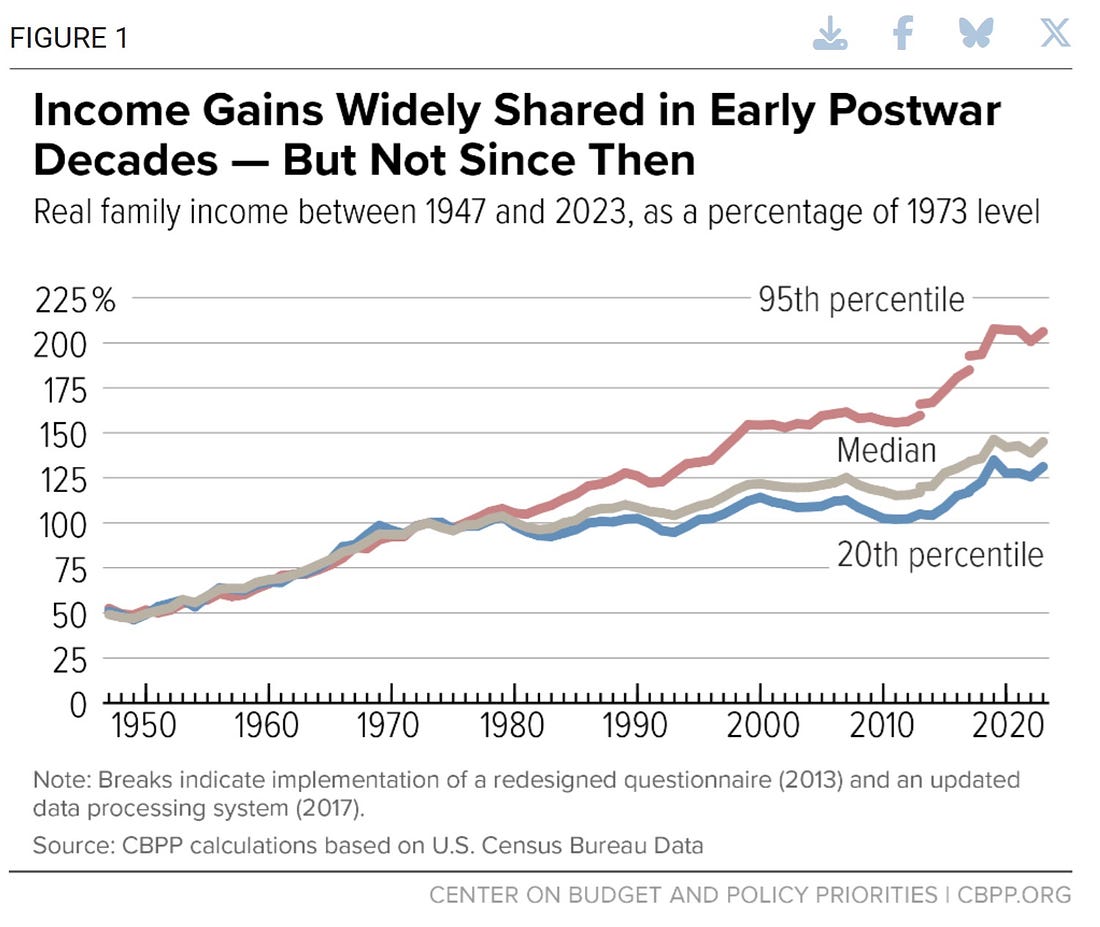

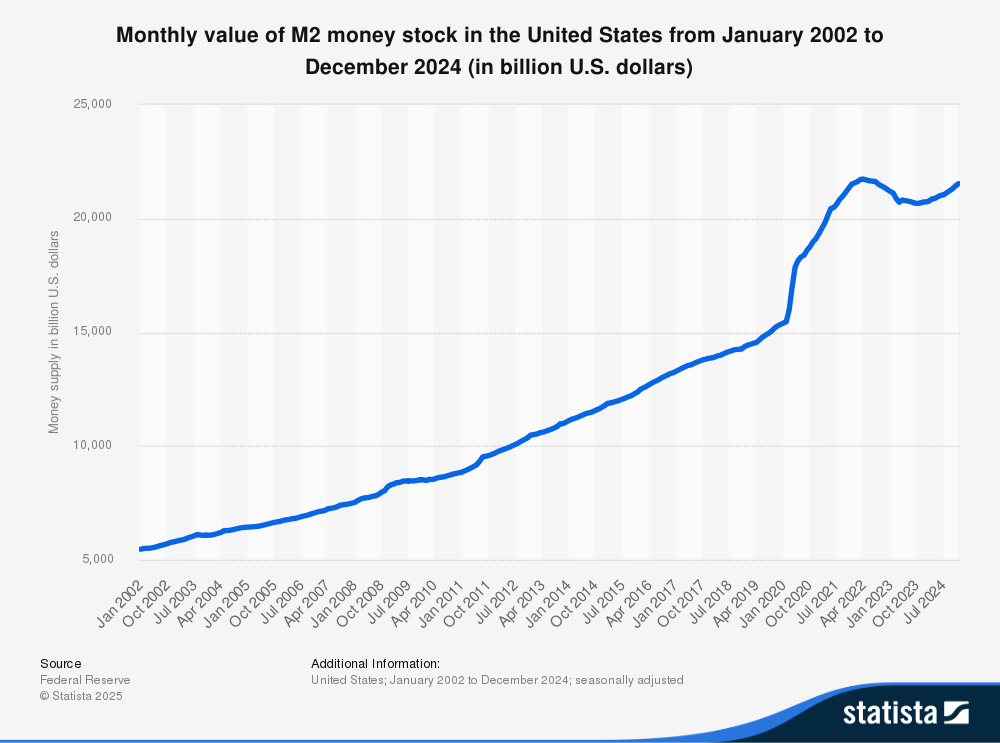

Last week we talked about the nuts and bolts of running America like a modern CEO or private equity fund would run a major company, including the strategy of gutting the institution to juice short term gains by converting assets into cash for the top shareholders. A major tool of this management strategy is financialization: the shifting of the focus and resources of an enterprise away from producing goods and services and toward financial engineering. Our politicians, funded and educated by the same financial engineers running hedge funds, big businesses, and Wall Street, embraced this management strategy for our country and, over the last few decades, have enacted policy that transitioned the American economy away from production and toward financial instruments. Today, we are going to talk about the damage financialization has done to our country and, more importantly, how it has impacted politics in America and created a vacuum of opportunity for any organized party that wishes to take it. To begin with, we need to recognize that financial instruments, based on money making money, are a zero sum game. Meaning that while they can be used to facilitate wealth creation, they do not themselves create wealth. If I lend you $100 at 5% for a year, you have to pay me back $105 at the end of the year. If you did nothing with that money for the year, you are five dollars poorer and I am five dollars richer. Wealth is transferred not created. This is very different from products and other services where wealth is created because the value of the final product is greater than the sum of its parts. Take manufacturing, where inputs like metal, plastic, and ingenuity are turned into a car or a computer. Or agriculture, where dirt and seeds become food. Or even education, where a building, teachers, students, and time combine to create knowledgeable and productive workers. Etc. That doesn’t mean that there isn’t value in financial services. Running a system that makes capital accessible to manufacturers, farmers, teachers, and others, so that they can effectively turn basic parts and ideas that they can’t afford into more valuable products or services is important. If a producer, given the capital, can take basic inputs and create an output that is 10% more valuable than the original, then that’s a win for society. The financial industry’s job is to make capital available and charge the right amount of interest (or set the right stock price) so that producers can affordably access capital and the financial industry can survive a reasonable failure rate and continue allocating capital. But as financialization grows relative to production, it exceeds its value in allocating capital and the excess financialization serves to do just one thing: transfer wealth to those who already have it. This is best illustrated by imagining the extreme: a country whose GDP is 100% finance. Now perhaps this could work if the lending is external to other countries, but if the full internal economy is just one person lending money to the next person and then to the next person, it fails. Those who started with money will continue to accumulate more capital through interest on their lending, and those who didn’t start with money will continue to accumulate debt. Wealth inequality will grow with every compound interest calculation and, with no one creating wealth, the whole system becomes mathematically impossible. Many people are familiar with interest payments on an individual level or relatively short time period and, through car or home loans or credit cards, have experienced how hard it can be to keep up with interest. But, to understand what high levels of financialization do to inequality at a national level, we need to look at things on a different scale. Instead of thinking in dollar terms (which are technically infinite, an important point later), we are going to use a finite resource that can stand in for dollars: gold. In this experiment, gold is lent out and the interest, compounded annually, must be paid back in gold. For example, if someone with a pound of gold were to lend it out at a 5% interest rate for 20 years, when all is said and done the lender should have 2.65 pounds of gold. Which means that the borrower or borrowers would have had to use the original pound of gold to generate enough to both pay back that pound plus 1.65 pounds of interest gold. That may not seem insurmountable, but what happens if you stretch it out to 100 years? Now the borrower would have to come up with the original pound of gold plus another 145 pounds. Just five times the number of loan years, but nearly 100 times the amount to pay the loan off. Let’s hope they had a good idea! That’s compound interest, and it gets even crazier at larger scale. What if, for example, in 1492 Christopher Columbus had taken a pound of gold from the Americas and, on behalf of Ferdinand and Isabella, promised that Spain would pay it back at 5% annual interest. The descendants of the original indigenous lenders just produced the note, how much gold would Spain owe them? Well, let’s just say the Spanish monarchy should have invested that pound of gold in grander exploration adventures than voyaging across the Atlantic, because it’s going to require a serious interstellar voyaging and mining capability to scrape together the 196 billion pounds of gold they would owe today when Earth is estimated to contain only 538 million pounds of accessible gold— a mere .027% of the total due. One more example, just to show how impossible this gets as the scale becomes larger: What if, to commemorate the death of Jesus, one of his followers had set aside just 1 measly gram of gold—about 1/5 of the gold in a wedding ring and an amount that would cost about $93 today, so a totally accessible amount— what if one of his followers had set that gram of gold aside and directed that it be invested with a 5% gold on gold return for 2000 years, after which the gold hoard would be built into a statue in honor of the lord. Can you guess how big that statue would be? Its mass would equal 1.2 billion suns. Yes, in just 2000 years, a relatively low five percent interest rate on a gram of gold consumes 4 million times more gold than exists in the entire galaxy (scientists estimate there are only about 300 sun masses worth of gold in the Milky Way). This is the absurdity of financialization at scale. We obviously aren’t at these extremes, but multiple studies of over-financialization in an economy have found that as financialization reaches a certain threshold, the economy begins to suffer because interest at scale is unsustainable. One study found that, as private debt (a proxy for financialization) exceeds 100% of GDP, the economy becomes more volatile, growth is restricted, and the country is worse off. In the US, private debt as a percentage of GDP reached that threshold in the early 1980s— and has well exceeded it since the early 2000s. If you compare the percentage of private debt chart to a wealth inequality chart covering the same period, you can easily see that as the US crossed that threshold and continued to exceed it, income inequality in the US grew by leaps and bounds. In other words, as expected, inequality accelerated rapidly alongside the deregulation and growth of the financial sector in America. And with trillions of dollars out on loan between those who have wealth and those who need it, the impact is getting more real with every passing year. Which brings us to the politics of it. In politics, the over-financialization of our economy has caught up to us and created two things: a group of people who are primed to rage against the institutions that squeeze and betray them every day, and an apathy among younger generations who see no hope as the system continues to snowball out of control. When I was recruiting for the Marine Corps the other day at Mizzou, one of the benefits that I was asked about the most was the VA Home Loan(!). Out of all the benefits, reasons, and other things to ask about, that one came up over and over again. Because our younger generation doesn’t think that they will ever be able to buy a home. Literally. And they’re not wrong. The median age of a home buyer in the 1980s was 31. Today it’s 56. Someone in the comments of my last post thought it wasn’t fair to call out boomer politicians for giving their generation the hookup over and over again and passing the buck to the rest of us. I get how that could make the boomers upset, but they were the ones buying houses in the 1980’s and they’re STILL the ones buying houses forty years later while my peers are frozen out. Because of the way the system has been transformed. It’s the same with student debt. Almost none for that generation while my peers are buried beneath it with no hope in sight. No one my age or younger thinks we will get social security, certainly not the way that everyone up until now has gotten it. In a financialized era where money now equals speech, entire generations who have been boxed out of the ownership class’s wealth feel like they have no voice. You saw that in 2024, when younger voters were lost or disenchanted and acted like it. And, of course, we all know where those raging against the institutions and establishment turned politically. The thing is, that the answer to turning things around could be in the question that people of all types asked me repeatedly on the campaign trail: why do we have inflation and what we can do about it. We have inflation for two reasons: First, because our financial sector has ballooned and the excess operates a zero-sum game that takes money from people who don’t have it and transfers it to those who do. As inequality continued to accelerate and all the “gold” began accumulating at the top, the problem that was temporarily solved by our country “printing” more money through deficit spending/quantitative easing and other tools at its disposal, to keep the system from toppling over.

But more money chasing goods (particularly when paired with a monopolized economy designed by the financial engineers) eventually creates inflation. The second reason we have inflation is because politicians refuse to pull money out of the economy through taxation on those who are hoarding it at the top. Instead, they do the opposite and, like a modern CEO, shower the top “shareholders”—corporations and the wealthiest Americans—with tax cuts, the equivalent of national share-buybacks and dividends. Other factors like corporate greed, monopolization, supply chain woes, are just byproducts of the above. It would be simple to reverse. Instead of taking an axe to our country and those who serve it, take the axe to the financial sector and chop it in half. Maybe we should have a financial sector “DOGE” run by federal employees showing them what efficiency actually looks like: the number of civil servants is the same as it was in the 1960s despite the population of the US growing by 68%. Instead of printing money to solve for the gold-interest problem (the fact that it’s impossible to have enough of a finite resource to maintain interest at scale), and to solve for the fact that excessive financialization redistributes money upward and creates an ever increasing demand for more cash in the economy to meet impossible interest demands, we should pull money out of the top of the economy the old fashioned way and re-inject it down below or into productive efforts. Instead of running our nation using a managed decline philosophy—stripping it for parts and passing the windfall to the top through massive tax cuts for the rich—we should invest in ourselves, our production, and our future. People will support politicians who they think are going to do one of two things related to the current economic situation: tear it all down, or fix it. Right now, they don’t believe any politician is capable of or willing to fix it, so by default voters are turning to the tear-it-down strategy. People don’t believe in the fix-it camp because they have been betrayed so many times. Anyone running on a fix it/change it mentality is going to have to take real steps to prove they are serious and, I know I’ve said it before, but that likely begins and ends with who they take their campaign money from. If they can do that, though, the reward politically— and in saving our country will be immense. The next few years the door on the political front is going to be wide open because the real problems aren’t going to be solved through tearing everything down (at least not what is currently being and likely to be be torn down). And people’s needs will continue to be unmet as the financial sector continues to consume everything like a massive growing black hole — or even scarier, a 5% loan at scale! A movement focused on this, and proving that it means it, has a real chance. I say a movement because it can’t just be one person. It needs to be a movement because it will require the resources to go against a machine that grows more powerful with every single compound interest period. Emotionally, the people in our country are already there. They just need something to believe in. Lucas The views expressed in this Substack are those of the individual only and not those of the Department of Defense. Use of military rank, job titles, and photographs in uniform do not imply endorsement by the Department of the Navy or the Department of Defense. Invite your friends and earn rewardsIf you enjoy Lucas’s Substack, share it with your friends and earn rewards when they subscribe. |

Saturday, March 1, 2025

An Entire Universe of Gold?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment